Scaling through AI in banking

Increase your business success through automated communication processes with your customers.

Arrange an expert meeting

Request a Live-Demo

REVOLUTIONIZE YOUR INBOX

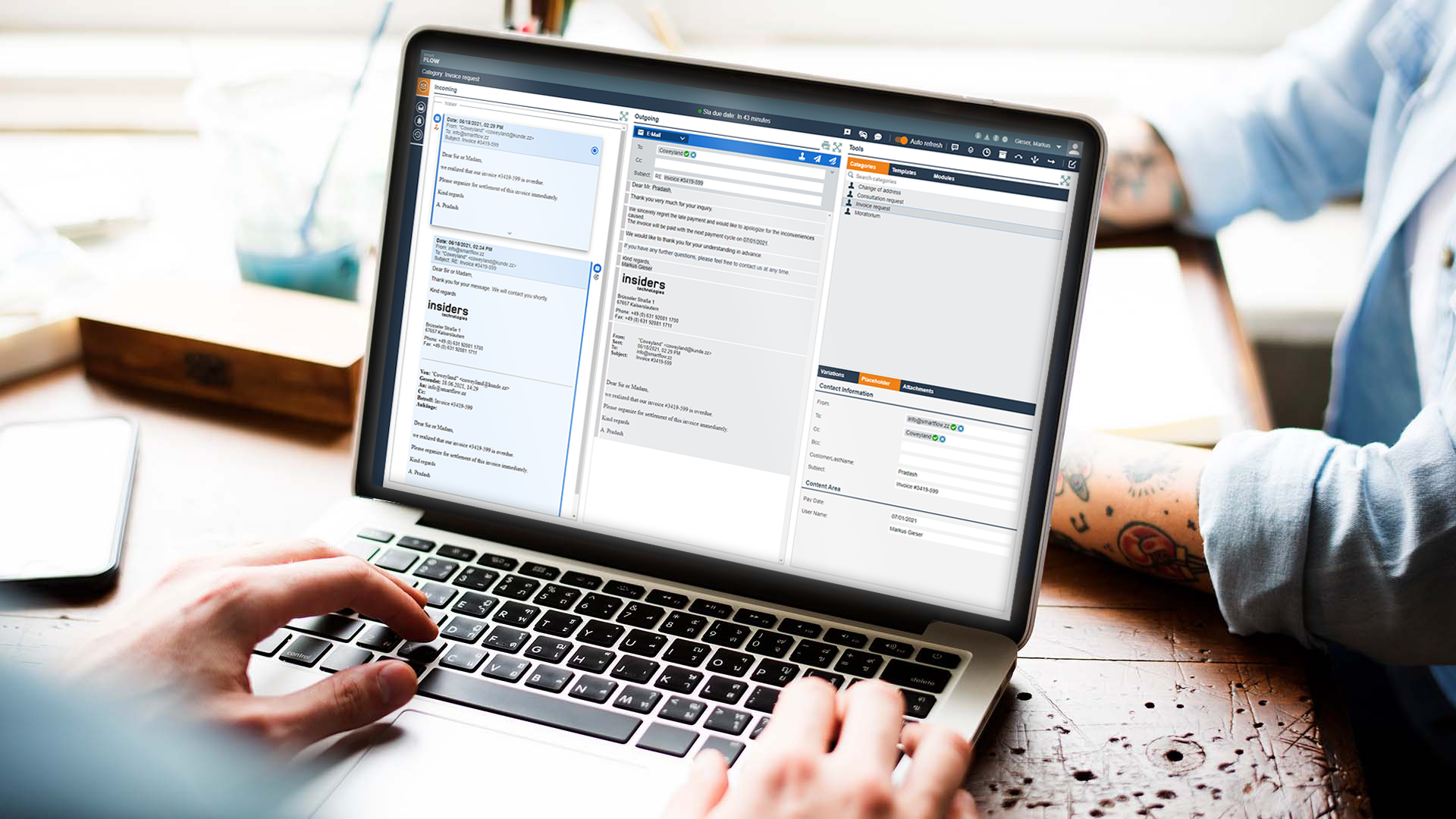

Whether it’s credit applications, account services, or documents related to mortgage financing – financial institutions face a deluge of messages and customer inquiries through various communication channels every day. Our AI-powered solutions for Banking & Financial Services Automation ensure the highest customer satisfaction – inquiries are no longer left unattended or sent to the wrong recipients. Thanks to the extensive portfolio of market-proven, industry-specific solutions, smart financial service providers benefit from numerous advantages.

a new approach to banking – ai-supported, efficient and customer-centric

We have developed intelligent tools tailored to the needs of your customers, providing unique added value. Utilizing the latest deep-learning technologies, our products extract all business-relevant information from incoming messages, automate processing and forwarding, and assist in providing appropriate responses to inquiries – or even take over these tasks themselves.

AI in Banking

Cost efficiency

Optimized customer experience

Sustainable banking

LOWER ERROR RATES

Increase in productivity

ENHANCED PROCESS CONTROL

Satisfied customers & rising sales

INCREASED CUSTOMER SATISFACTION AND HIGHER SALES REVENUE

Automating and structuring your incoming communication with powerful software is of course not an end in itself. By swiftly and precisely processing and responding to customer and prospects, you enhance crucial factors such as operational SLAs and customer satisfaction. In this way, you make a sustainable investment in the successful future of your business.

Success stories from our customers

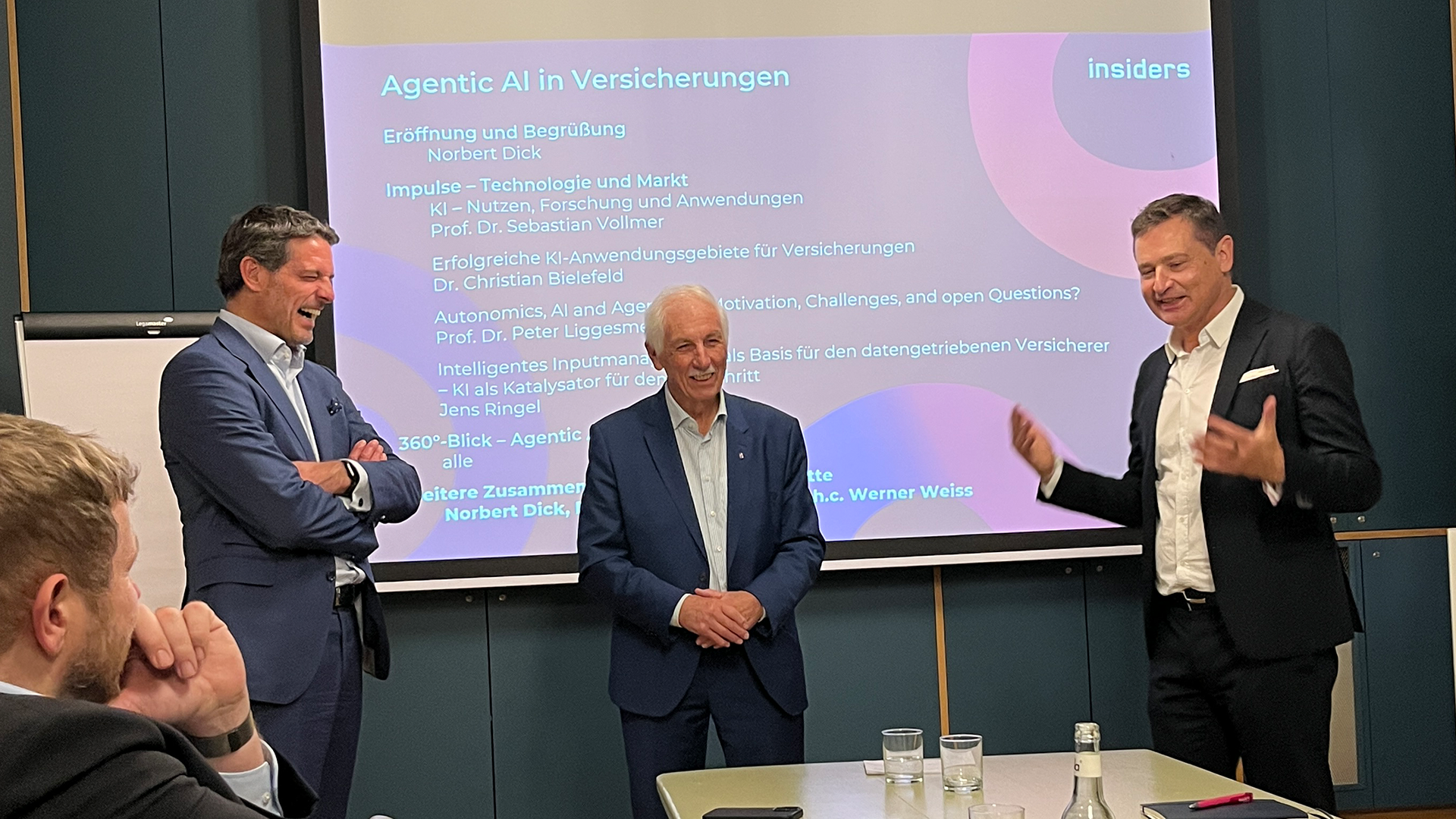

AI in companies increases efficiency, reduces costs and opens up new innovation potential in almost all industries. Our customer use cases show how successful process optimization makes companies more efficient and innovative. By using intelligent solutions, they have been able to optimize their business processes and achieve sustainable competitive advantages. Be inspired by our success stories!

UNPARALLELED RECOGNITION

Whether it’s next-generation OCR, state-of-the-art machine learning approaches or the latest validation processes – our aim is to be at the forefront of technology. And it is this claim that is reflected in impressive results. Let the performance of our solutions convince you

Construction financing

Incoming construction financing documents such as building status reports, tradesmen’s invoices etc. are recorded across all channels using AI, automatically classified and relevant data extracted from the documents. Seamless integration into the downstream systems ensures consistent, seamless processing across all channels. This speeds up processing considerably, reduces manual effort and increases the customer experience and process reliability at the same time.

Credit processing

Incoming loan applications and associated documents are automatically classified using AI, relevant creditworthiness information is extracted from proof of income or bank statements and forwarded directly to the relevant systems or specialist employees. This reduces manual checking efforts, shortens processing times and ensures consistent, transparent processing – while also increasing customer satisfaction and significantly reducing process costs.

State-of-the-art technology for banking processes

How do we ensure that our software structures, interprets, responds to, and forwards messages and requests to the right recipient? As a spin-off of the German Research Center for Artificial Intelligence, we have been developing, operationalizing, and optimizing cutting-edge technologies for decades. You don’t need to understand exactly what intelligent automation, deep learning, or generative AI are! What’s more important is that you can use them to significantly improve the quality and speed of customer service or credit approval processes.

OmnIA – the automation platform

Accelerate your input management processes with our OmnIA automation platform. Our flexible and scalable solution enables seamless integration of different systems, applications and technologies – for consistent, automated workflows without media disruptions. Thanks to open standards and powerful process modeling, you can optimize complex processes, reduce manual intervention and increase the efficiency of your entire value chain. This allows you to create a future-proof automation strategy that can be flexibly adapted to new requirements.

AUTOMATED COMMUNICATION

Our software not only forwards messages to appropriate recipients – from customer advisors and support teams to qualified decision-makers – faster than any human, it can even answer typical inquiries on its own or provide intelligent suggestions to the processors. In conjunction with its easy and seamless integration into your system, this saves you valuable time and ensures the sustainable optimization of your processes.

build your own service

With the help of the Insiders GenerAItor, you can easily create your own automation service without any programming knowledge